Top 50 EduTech Tools In Higher Education 2019

Your exclusive guide on Best-In-Class EduTech tools for academia

Your exclusive guide on Best-In-Class EduTech tools for academia

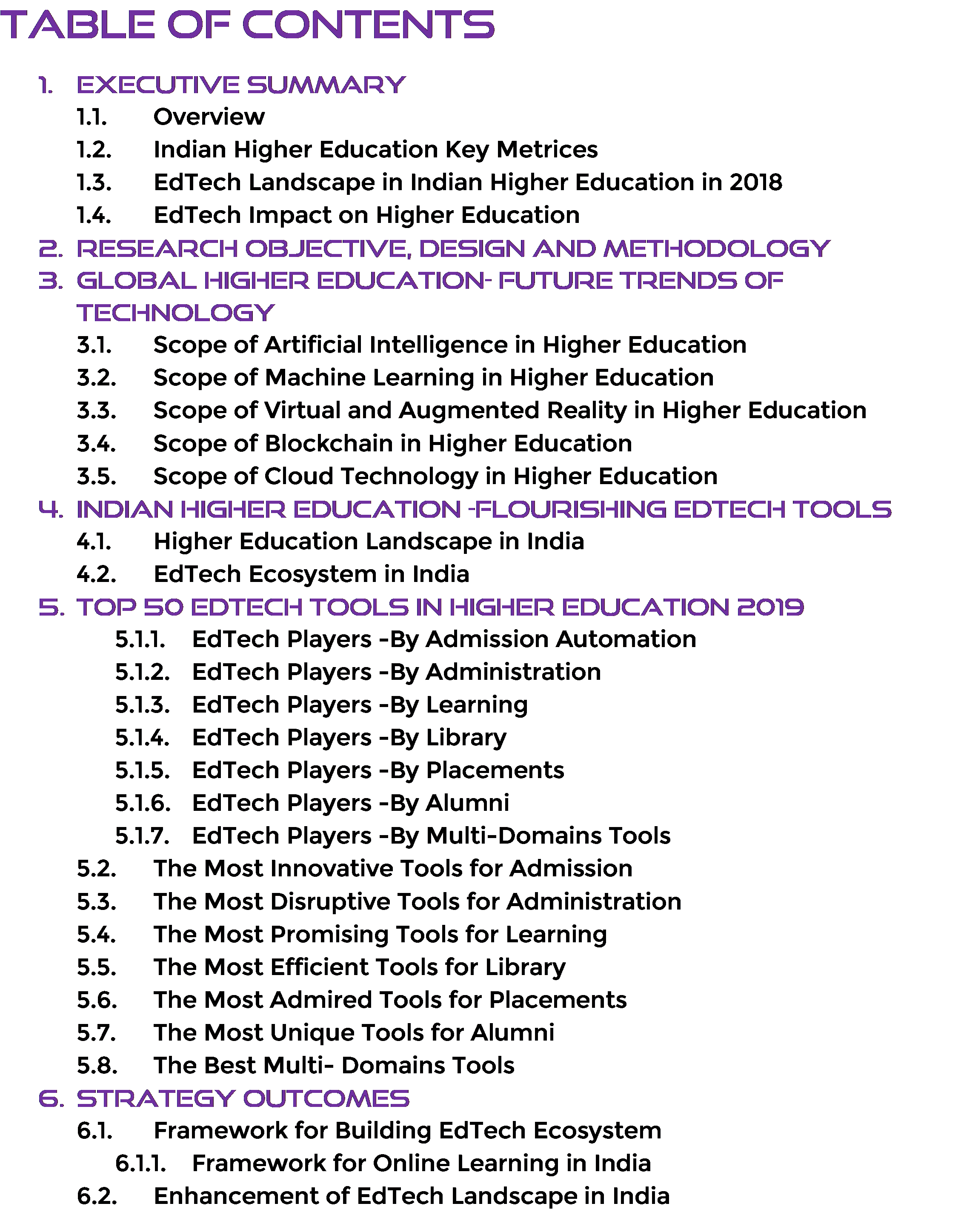

Out of 3500+ EdTech startups and 4000+ EdTech tools available in the market, it is difficult for decision-makers to identify the right tools for their institute or university.

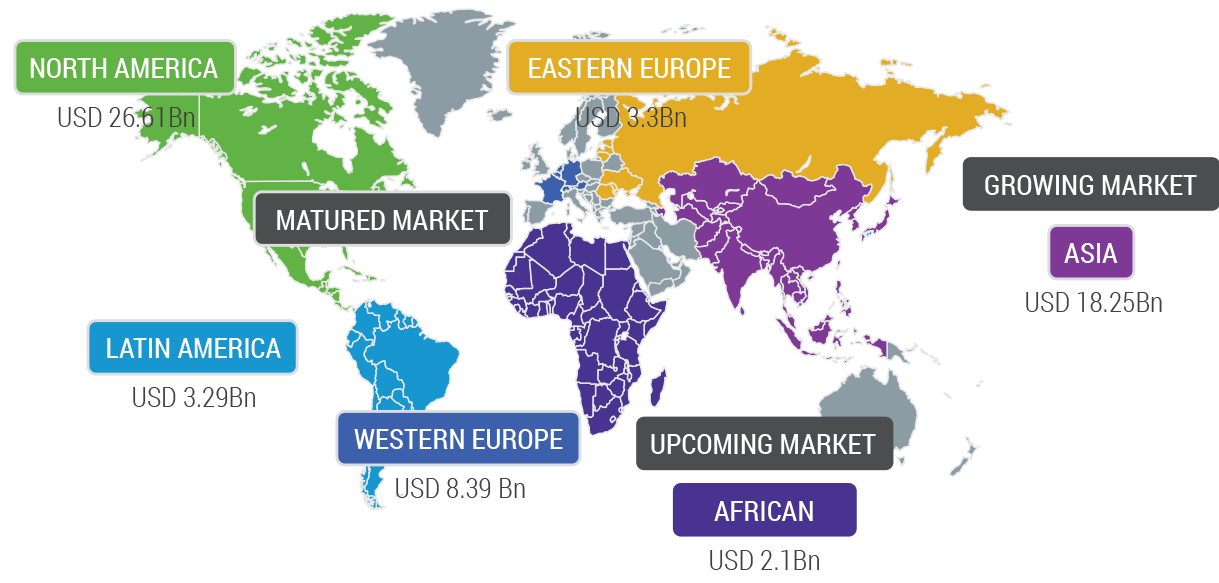

Get in-depth insights on global EdTech landscape, growth and future perspective of EdTech in India Higher Education.

As a decision maker of an education industry, you must be aware that India is leading the EdTech revolution in the 21st century and reasons are cultural transformation, increasing education demand and advanced technologies.

saurabh@asmaindia.in

+91- 9823054224

yogesh.suthar@asmaindia.in

+91-7420067441

Copyright 2019 @ Adoption of Social Media in Academia.